Retirement Plan

Participants and Employees

Discover Your

Retirement Readiness

Your employer has taken the first step by providing you with a retirement plan to help you meet your future goals. While this creates the foundation for saving toward retirement, what does it all mean?

Standard of (k)are Advisors takes a specialized approach to helping you understand

your true Retirement Readiness. By engaging through Standard of (k)are™, we are able to provide each participant with a hypothetical analysis of how long savings are expected to last as a supplement to your income needs. Through this process we are able to assist savers with:

Enrollment

Online Account Access

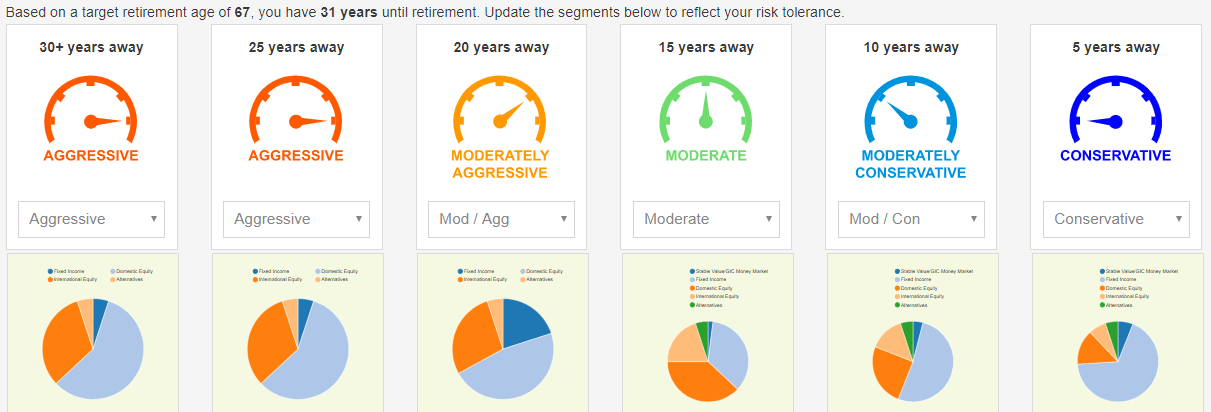

Investment Risk Tolerance

Preferred Investment Style

Investment Menu and Fund Selection

Plan Specifics & Terminology (vesting, mutual funds, eligibility, loans, etc.)

Understanding Plan Costs

Contribution Rate Projections

Maximizing your Employer’s Contribution (if applicable)

Budgeting & Income Needs Analysis

(k)ustom Education

Financial Wellness

Your Account Options When You Change Employers

Becoming Ready for Retirement!

We encourage you to take the next step toward Retirement Readiness by meeting with one of our licensed, independent financial professionals who will help guide and prepare you. Plan to attend one of our virtual educational group meetings or speak individually with an advisor to talk about your specific situation and your retirement goals.

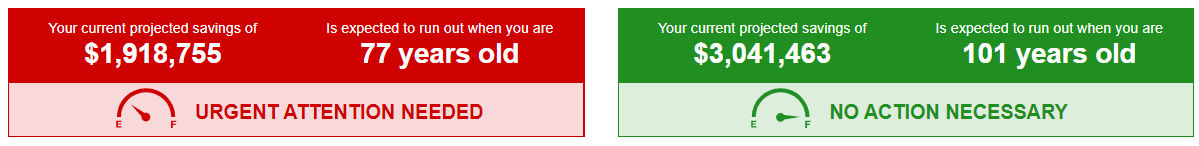

Individual meetings are held virtually. We discuss how much risk you are comfortable taking on, walk you through the different investment options that are available to you, and how the different pieces of your financial life fit together. We help you develop a vision for your retirement and implement the steps needed to manifest your visions. The outcome is a clear picture of your Retirement Readiness, so you can prepare now for a successful retirement later.

We use SOK™’s (k)ustom Education tool that allows us to track your retirement financial goals, if they are being met, what adjustments you may need to take, and send email reminders directly to you. This automated, ongoing communication will allow further education for you and help you better understand the actions you need to take for your Retirement Readiness.

Our financial professionals are available to answer any questions you may have about your employer’s retirement plan and can help you with plan enrollment or assist you in consolidating your retirement accounts.

¿Estás buscando un asesor que habla español y puede ayudarte con tu beneficio 401(k)? Estamos aquí para ayudarte. Contáctanos ahora para conversar.

Talk to us:

Drew Kennedy

608.826.2906

Drew.Kennedy@sokadvisors.com

Lisa Conwell

608.826.2904

Lisa.Conwell@sokadvisors.com

SOK Advisors are retirement plan advisors only and do not provide wealth management services. If you are looking for additional help outside of your retirement plan, we will provide you a referral to our strategic partner Source Financial.

Account Information

Choose from a list of various plans’ record keepers.

Separation Services

You have choices. We’ll help you make the right one.