Retirement Plan

Fiduciaries and Employers

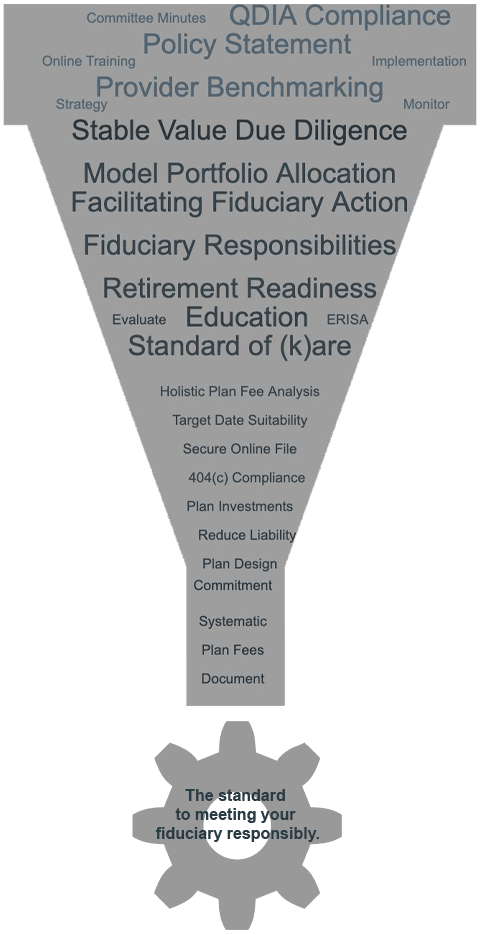

Standard of (k)are Advisors pair team spirit with fiduciary services

Standard of (k)are Advisors offers a team-based approach to servicing our clients. From the boardroom to the break room, in a proactive, data-driven process that goes far beyond the basics of funds, fees, and fiduciary responsibilities, our structure allows for personal and individual interaction with every participant to help them achieve Retirement Readiness.

SOK Advisors offers a modern solution to the current times and has defined the way we meet with participants by offering a fully virtual team. We are here to help and want you to know your participants are being taken care of. Our new technology enables us to send email communication and campaigns directly to participants. By utilizing our retirement plan management software and Standard of (k)are™ tools, we guide participants in building and implementing an effective action plan. We use the information from employee meetings to facilitate decisions in the boardroom and to enhance and customize the plan to fit each participant’s needs. Our team drives conversations toward Retirement Readiness and focuses on steps participants can take today to achieve their retirement goals.

Let SOK Advisors be your Board Room educator. We focus on educating plan fiduciaries by helping them understand their fiduciary responsibilities and the associated liabilities. In addition to providing scheduled plan reviews, we host fiduciary training focus groups for plan sponsor clients throughout the year. Coupled with a Fiduciary Training Program and implementation of industry best practices, we are able to empower plan sponsors with the necessary knowledge to be better fiduciaries.

From the boardroom to the break room, SOK Advisors delivers.

In the Boardroom…

Too often, we find one of the largest issues facing plan sponsors is a lack of knowledge and understanding of their roles and responsibilities as a plan fiduciary. There is an assumption that simply having a plan, provider, and advisor is enough. As Fred Reish once said, “Fiduciaries are not sued for what they do, instead they are sued for what they do not do.” Our Boardroom services begin with a fiduciary overview and introduction to Investment Committee basics including fiduciary requirements, committee formalization, and documentation practices.

With Standard of (k)are’s™ Avatar feature, we go beyond monitoring traditional plan success metrics and “personalize the plan” to the fiduciary by presenting the average age, target retirement age, average deferral rate, outside savings, retirement income needs, plan dependency, risk tolerance, investment allocation, and the age at which retirement savings are expected to run out. This level of data analysis truly defines the benchmarks used to measure plan and client success.

As a starting point, each committee member is required to complete a fiduciary appointment and acknowledgement letter, vowing to act only in the best interest of participants, avoid conflicts of interest, act prudently, follow plan documents, adhere to a documented and ongoing process for investment decisions, and pay only reasonable expenses. All of these obligations are efficiently fulfilled and recorded through Standard of (k)are™. Where each committee member is provided a secure login and training on the platform.

SOK Advisors is here to make it easy. All of these are taken care of by plan fiduciaries at their best.

Plan sponsors are able to efficiently document the management of these responsibilities while adhering to industry best practices in a centralized location through Standard of (k)are™.

Retirement Readiness is our mission. This mission is accomplished by educating to make better them plan fiduciaries. Standard of (k)are Advisors offers an online fiduciary training program to help expand the knowledge level of plan sponsors to gain a better understanding of their fiduciary roles and responsibilities. Many employers engage with SOK Advisors as a fiduciary in relation to plan investments under ERISA Section 3(21) or have SOK Advisors act as a 3(38) investment manager in select advisory relationships.

Does it matter how

my advisor gets paid?

On the surface, how your advisor gets paid may not seem important. With appropriate benchmarking, you may find that it can make a big difference to you, as a plan sponsor, and also to participants in your plan.

“Plan sponsors have liabilities associated with their retirement plan. A wise fiduciary will recognize their limitations and seek out expert advice to help mitigate those liabilities while seeking to improve plan results.”

— Chris Krueger, Founder, Managing Partner

In the Break Room…

At Standard of (k)are Advisors, we have progressed beyond focusing only on increasing participation and deferral rates to focusing on the necessity of retirement plans to provide income replacement in retirement. Through Standard of (k)are™, we not only measure, but track the Retirement Readiness of every single participant we work with. We continually increase participant Retirement Readiness in our plans through regularly scheduled group education meetings, virtual educational meetings between advisors and participants, and SOK Advisors’ virtual Participant Outreach Program.

Participant Outreach and Education Services

Standard of (k)are Advisors strive to ensure every plan participant receives the care and attention they deserve. Our team directly contacts each participant with the goal of offering plan specific education. This is achieved during scheduled phone calls and virtual visits with our advisors.

SOK Advisors’ service center is also available to answer any questions participants may have about enrollment, contributions, investment risk tolerance, investment choices, savings, income sources, budgets and overall retirement planning. We work with new employee enrollment staff to assist employees with getting into the plan properly. Our team is also available to assist with separation services, helping individuals as they retire or change careers to determine their best options as they leave those jobs.

Our virtual team creates custom video content to mirror your understanding of the work force and knowledge of retirement planning.

We develop an interactive education program driven toward reaching the client goals and education objectives outlined in an Education Policy Statement. Through Standard of (k)are™, we provide (k)ustom Education within the SOK™ software that allows us to track participant’s retirement financial goals, whether they are being met, and what adjustments (if any) are needed. Follow up email reminders are sent directly to participants. This automated, ongoing communication allows further education for participants and helps them better understand the actions they need to take for their personal Retirement Readiness. In addition, by utilizing the Retirement Readiness calculator, we can show the participant the benefit of a company match and how years of income replacement in retirement are added because of the company’s contribution to their account. This conversation stresses the importance of taking full advantage of the company match, and it helps cultivate an appreciation for the company contribution into individual accounts.

“A plan sponsor can offer a well-designed plan with the best features, investments and benefits, but the plan is not successful until the very last employee understands how to utilize the plan to their best advantage.”

— Chris Krueger, Founder, Managing Partner

Talk to us:

Retirement Plan Services Manager

Ashley Haubrich

608.826.2901

Ashley.Haubrich@sokadvisors.com